Two Ways to Fund Your Home Improvement Project

Before starting your next home improvement project, it’s important to do a construction loan vs HELOC comparison.

With home values on the rise, a hot real estate market making moving less desirable, and Americans spending more time at home, homeowners all over the country are choosing to spruce up their current homes. In fact, spending on home renovation and repairs is expected to grow nearly 4% year-over-year in 2021.1 And for big-ticket upgrades — like a kitchen, bathroom, new roof, or addition — they have options for how to pay for it.

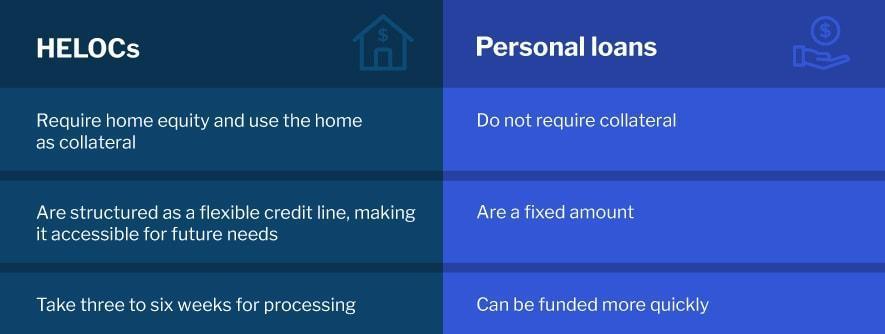

After deciding whether you’ll outsource the project or DIY, you’ll want to determine an estimate for the project cost. Then it’s time to weigh your financing options. Two of the most common ways to bankroll home improvement projects are home equity lines of credit (HELOCs) and personal loans.

HELOC vs personal loan

Rates and Repayment

To qualify for a HELOC, you need to have equity in your home. Typically, the amount of your primary mortgage plus the limit of your HELOC cannot exceed 85% of your home’s appraised value. For example, if your home is worth $400,000, your primary mortgage amount outstanding plus your HELOC cannot total more than 340,000. Your home serves as collateral to secure the loan.

Using a personal loan for home improvements a good option for those who don’t want to use their home as collateral or who don’t yet have sufficient equity in their home. The repayment terms are often shorter (typically two to seven years compared with as long as 30 years for a HELOC), so while your monthly payments may be larger, your debt obligation will end more quickly.

Because collateral isn’t required, personal loans typically have higher interest rates than HELOCs. Like all loans, however, your interest rate will ultimately be determined by your credit score, debt-to-income ratio, and other factors.

Timing

When evaluating a HELOC vs personal loan, you’ll also want to consider your timing. The process for funding a home equity loan can take three to six weeks, which might be too long to wait in the event of a time-sensitive project (like a new roof or replacement refrigerator). Personal loans, once approved, are typically funded within a week and in some cases, as quickly as the next business day. Applying for a personal loan can be as simple as a short online form followed by a basic document review. The typical HELOC application, however, requires property evaluation and underwriting processes after the application and document review steps.

Fees

Tangential costs are also a consideration. Like traditional mortgages, HELOCs come with closing costs. Composed of fees for applications, underwriting, appraisals, title, and escrow, these can amount to 2% to 5% the total loan amount. Personal loans, on the other hand, may or may not include a modest origination fee, depending on your state of residence.

Your decision on what type of financing to pursue will depend on several factors, including the scope and timing of your intended project. If using a personal loan for home improvement turns out to be the right choice for you, check out your loan options with no obligation or impact to your credit score.

Source:

- “Home Remodeling Set For Stronger Growth In 2021,” Jan. 21, 2021, Harvard Joint Center for Housing Studies