4 Common Questions About Personal Loans

What is an unsecured personal loan? Consider this your guide.

Life can come with major (and sometimes surprise) purchases — and it’s not unusual to need help managing those costs. That’s why people may consider borrowing money. In fact, more than half of Americans have taken out a personal loan in their lifetime.1

Whether you’re funding a wedding or paying a car repair bill, there are many reasons to look into different funding sources. But is a personal loan right for you? With a little research, you can make the decision that best fits your financial goals. Here are common questions and answers to consider.

What is a personal loan?

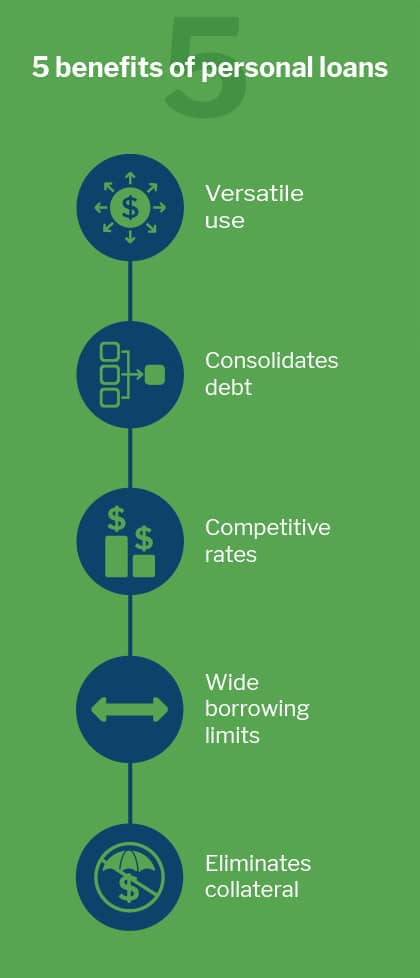

When you take out a personal loan, you’re borrowing money from a bank, credit union, or online lender. You pay those funds back in fixed monthly payments. Although these loans can be used for different purposes, many people use them to help cover personal expenses. Think: vacations, medical bills, home renovations, and debt consolidation. Borrowing amounts range from a few thousand to tens of thousands, and the average payback period typically ranges from one to seven years.2

Most personal loans are unsecured, which means they’re not backed by collateral like a house or a car. Lenders will typically rely on information like your credit score to determine whether you qualify. The better your score, the more likely you can secure a low interest rate — reducing the total amount you’ll repay over the term of the loan. Keep in mind that like other forms of credit, such as a credit card, a personal loan can boost your credit score if you pay it back on time.3

How long does it take to get a personal loan?

The process may depend on factors such as the type of lender you borrow from and the accuracy of the information on your application. In general, online lenders tend to be the fastest option if you need money quickly and may take as little as one business day once the loan is approved.4 By comparison, banks and credit unions may need up to seven or more.4

While every application is different, there are ways to speed up the process.

3 tips for faster approval

- Check your credit score: Before you apply, look at your credit score and verify your report is free of errors. Knowing your score can help you find the right lenders who will work with your qualifications.

- Review your application: An application with correct information will prevent time-consuming obstacles. If there are errors, your lender will have to contact you.

- Get pre-qualified: After completing a short application, your lender will run a soft credit inquiry (that won’t affect your credit score) and present loan offers you qualify for.

What is the interest rate on a personal loan?

Your interest rate — a percentage of the loan principal that lenders charge — will be based on factors like your credit score. Because personal loans have a fixed repayment term, they frequently offer a lower rate than credit cards.

Don’t forget to also consider the annual percentage rate (APR), which includes the interest rate plus additional charges. Origination fees, for example, cover the costs of processing your loan application. It’s worth looking into opportunities to reduce those fees: A higher credit score, for example, can mean a waived origination fee, while setting up autopay may reduce your interest rate.

Some applicants wonder: Is personal loan interest tax deductible? Although the answer is usually no, there are exceptions — so ask a tax professional if that might apply to your situation.

Can you refinance a personal loan?

Good news: personal loans can be refinanced. This strategy involves taking out a new personal loan to pay off the old one for the purpose of saving money on interest or extending the payment term. If the new loan has a lower rate, you may reduce your monthly payments.

Before you move forward, it’s also important to consider potential challenges. For instance, you might spend more in interest for a longer repayment term. Plus, if the lender charges an origination fee on the new loan, you should factor in that extra cost. To avoid confusion, make sure to check with your lender about their policies.

The decision to use a personal loan is different for everyone. When you know the answers to common questions about personal loans, it may be easier to figure out the option that works for your lifestyle.

Getting a personal loan can help you reach your financial goals. Check your loan options today, with no obligation or impact to your credit score.

Sources:

- “Personal loans statistics,” March 8, 2021, Finder.com

- “What is a personal loan? Terms to know,” Oct. 12, 2021, Credit Karma

- “How Does a Personal Loan Affect Your Credit Score?,” July 6, 2021, NerdWallet

- “How Long It Takes to Get Approved and Get a Personal Loan,” Oct. 14, 2021, Credible